A crypto heatmap is a potent visual medium that shows price action for a variety of cryptocurrencies at one time. By color coding—the price rising is usually green and falling is red—these maps enable users to immediately understand market direction. The hue gets brighter or darker to show the size of price moves, so one can quickly see which assets are moving well or badly by looking at a map, without having to look at a series of charts or spreadsheets of numbers.

Crypto heat maps arrange digital assets in many different ways, such as by market cap, trading volume, or category. This arrangement provides traders with not only an individual asset’s performance but also wider market movement. For instance, a red ocean of the leading cryptocurrencies is indicative of an overall market drop, whereas pockets of green within a red ocean can show traders areas where specific assets are moving counter to the prevailing trend.

1. Why Crypto Heatmaps Matter for Traders

The human brain perceives visual data more quickly than text or digits. This is where crypto heatmaps shine—taking difficult-to-understand market data and translating it into easily grasped visual patterns that are comprehensible in mere seconds. Such rapid visual processing enables faster decision-making by traders, something especially useful in the highly dynamic cryptocurrency markets, where things can change very quickly and opportunities can only last for short periods of time.

Crypto heatmaps are also great at showing correlations between various digital assets. When some cryptocurrencies tend to move together on the heatmap, traders can spot potential correlations. These observations assist in portfolio diversification strategies since you can steer clear of holding too many assets that tend to move up and down together. Knowing these correlations becomes important when creating a balanced trading portfolio.

2. Key Features of Effective Crypto Heatmaps

Time period switching is a key characteristic of any decent crypto heatmap. Having the option to switch between various periods—ranging from minutes to months—enables traders to align their analysis with their trading strategy. Day traders may prefer 5-minute or hourly movements, while investors with a longer-term focus may find daily or weekly views more useful. This flexibility makes crypto heatmaps useful tools for many different trading strategies.

Asset filtering functionality adds value to crypto heatmaps by enabling you to zoom in on portions of the market that interest you. You may wish to see only top-tier cryptocurrencies by market capitalization, a particular class such as DeFi tokens, or a personal watchlist of tokens you’d like to monitor. This filtering prevents information overload and ensures your analysis remains targeted at your trading goals and interests.

3. Applying Crypto Heatmaps for Market Sentiment Analysis

Crypto heatmaps are great markers for overall sentiment across the crypto landscape. A sea of green heatmaps indicates widespread bullish momentum in the cryptocurrency world, while a sea of red signals bearish sentiment. By frequently examining a crypto heatmap, traders will gain an instinctive sense of market conditions and adjust strategies based on what they see, be it hunting for buys when selling off or capturing profits in runaway uptrends.

Sector rotation—where money flows from one category of cryptocurrency to another—is revealed by heatmap analysis. You may see gaming tokens heating up while DeFi tokens cool down, for example. These trends can be the first sign of shifting market narratives and new themes. Clever traders utilize crypto heatmaps to catch these rotations early and position themselves before general public attention pushes prices further.

4. Identifying Trading Opportunities with Heatmaps

One of the most useful uses of crypto heatmaps is outlier detection. When everything else is trending in one direction but a few assets trend very much in the opposite direction, those outliers are often good trading opportunities. A lone green asset amidst a red ocean may represent strength that may persist even while the rest of the market is flailing, providing a potential short-term trade.

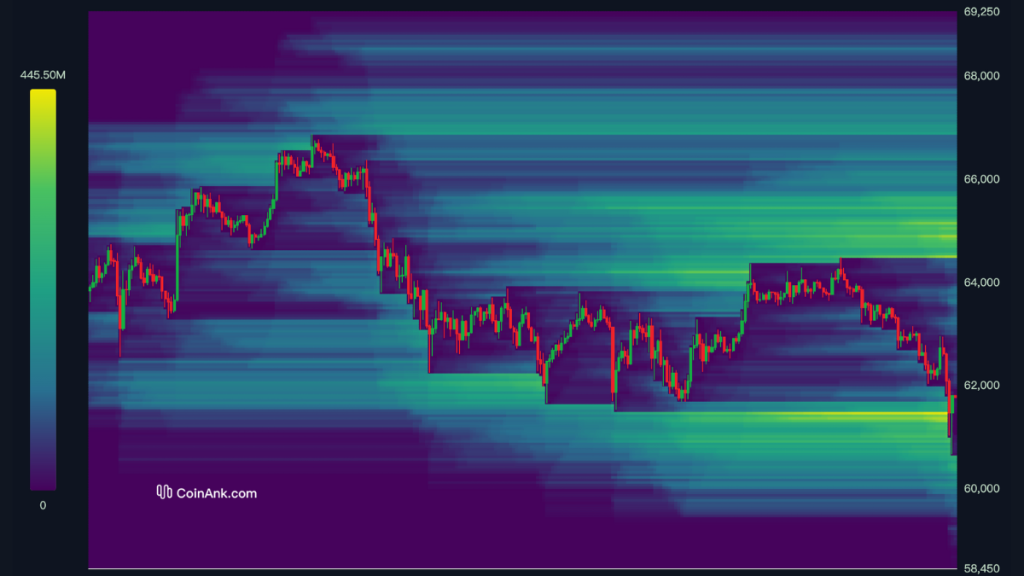

Crypto heatmaps also assist in determining possible support and resistance levels on a group of assets at once. When a group of major cryptocurrencies reach resistance all at once, it usually means a market-wide ceiling that may be hard to breach. On the other hand, observing various assets finding support at the same percentage declines could mean a good time to buy the dip.

5. Combining Crypto Heatmaps with Other Analysis Tools

Though strong on their own, crypto heatmaps are even stronger when paired with conventional technical analysis. Utilize the heatmap for fast market snapshots and finding interesting assets, then transition to candlestick charts to validate patterns, analyze volume, and set accurate entry and exit points. This complementary system offers breadth and depth to your market analysis.

The basic analysis also complements crypto heatmap insights. When you see interesting movements on the heatmap, check if there are some fundamental reasons behind such price movements. Is there some good project development news? Has there been a major partnership announcement? Knowing the “why” behind price movements that you observe on crypto heatmaps allows you to differentiate between fleeting volatility and more meaningful trends to trade.

6. Advanced Heatmap Trading Strategies

Correlation trading takes advantage of the visual patterns exposed by crypto heatmaps. When suddenly diverging assets that normally move together, this “correlation breakdown” usually offers trading opportunities. For instance, if two comparable DeFi tokens normally move together but one falls behind during a rally, there could be a catch-up trade opportunity. Seasoned traders routinely monitor crypto heatmaps for these correlation anomalies.

Momentum trading techniques suit crypto heatmap analysis. By seeing what assets are displaying the most color intensity (green or red), traders can identify cryptocurrencies with major momentum. This method relies on the fact that assets increasing or decreasing value quickly tend to do so in that direction for a while. Crypto heatmaps reveal these momentum opportunities in real time without having to look at several charts.

Conclusion

Adding crypto heatmaps to your trading process can greatly enhance your market insight and decision-making. Begin every trading session by quickly scanning the heatmap to get an overall sense of the market conditions prior to delving into individual assets or strategies. The result will be being able to contextualize any one trading opportunity in the larger market environment, avoiding tunnel vision on only a handful of assets.

As with every trading instrument, crypto heatmaps gain their utility with time and experience. Eventually, you’ll intuitively realize what various patterns on heatmaps generally represent about the market and how they pertain to your own individualized trading tactics. With practice that is patient over time with crypto heatmaps, you will see them transition from cool visual representations to robust instruments of your own trading advantage within the dynamic currency markets.